A Decade in Review: the African Art Market

Introduction: From Marginality to Market—and Back to First Principles

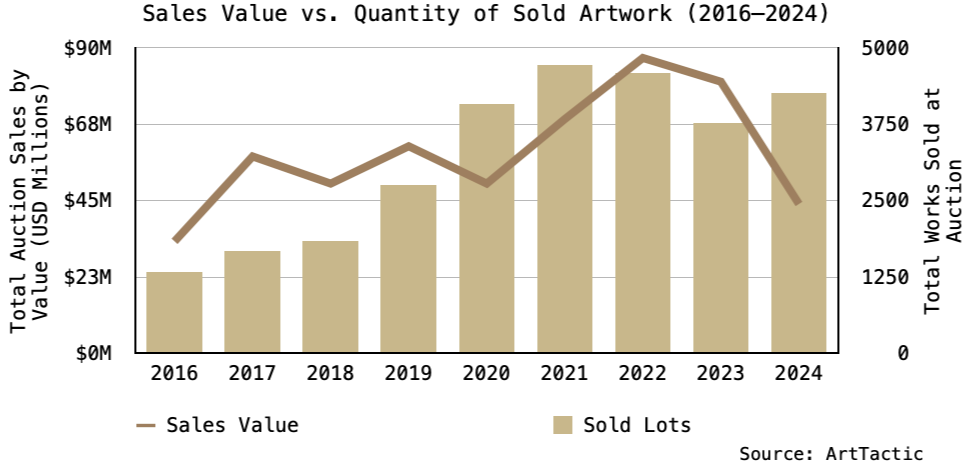

What did the last decade actually deliver for the African art ecosystem? Not in terms of headlines— those we have in abundance—but in terms of structural resilience, institutional depth, and the capacity to sustain value when macro conditions turn. The African art auction market grew from $33 million in 2016 to $87 million in 2022—a 160% increase—before falling to $44 million in 2024. The correction reveals what the boom obscured: commercial platforms can manufacture visibility, but this is no substitute for institutional depth. My argument is straightforward: the last decade proved that when platforms recalibrate—either because macro liquidity tightens or because internal strategy shifts—the market is forced to reckon with what it actually built, and what we built was fragile: over-concentrated, under-institutionalised, and structurally vulnerable. But beneath the volatility, something more durable persisted: a base layer that held even as headline values fell. The correction separated speculators from loyalists and investment narratives from actual collecting practices. That separation is clarifying. It tells us what the next decade must prioritise: not another cycle of platform-driven heat, but the slow work of building backstops— institutions, archives, scholarship, local validation infrastructure that can carry value independent of auction calendars.

Reading the Divergence Between Value and Volume

If we look only at headline sales totals, 2024 appears catastrophic. Auction results, which are the only reliable data available for the market, show a 45% year-on-year decline in total transaction value to $44 million, according to ArtTactic, but the data contains a decisive counter-signal.

A comparison of total auction values in comparison to the number of works sold suggest the market is wider than the headline total suggests. Total transaction volume at auction grew 13% in the year to 2024, largely recovering from the 2023 low of 3766 lots at auction. This reflects the increased participation of a cohort of buyers collecting for interest rather than timing exits, operating at lower price points where market mood matters less than conviction. The top end, by contrast, is extraordinarily fragile. This trophy layer is highly sensitive to market sentiment and dependent on discretionary supply of high value works. This is how we get to the present paradox. Sellers who bought at peak prices either refuse lower valuations or sell at significantly lower prices. Those who remain are dedicated collectors operating with longer time horizons.

The Loyalist/Speculator Divide: Who Built the Boom, and Who Stayed?

The boom attracted two types of buyers: Loyalists, characterised by their deep engagement with the category, motivated by cultural affinity and a willingness to support emerging artists and postcolonial modernists—they view downturns as opportunities to collect undervalued works; and speculators who were attracted by the market’s upward momentum and the post-2020 imperative to collect Black art. The latter pre-marked exits based on projected appreciation of the market. When growth reversed, they held works whose cost basis assumed exit prices the market would not support. Consequently, many withdrew—this is why the trophy tier contracted sharply, whilst loyalists increased participation. The repricing is a compositional shift back to the loyalist base. Meanwhile, loyalists increased participation. They did not stop collecting when prices fell—they saw correction as opportunity. This cohort sustained transaction volumes even as headline values compressed.

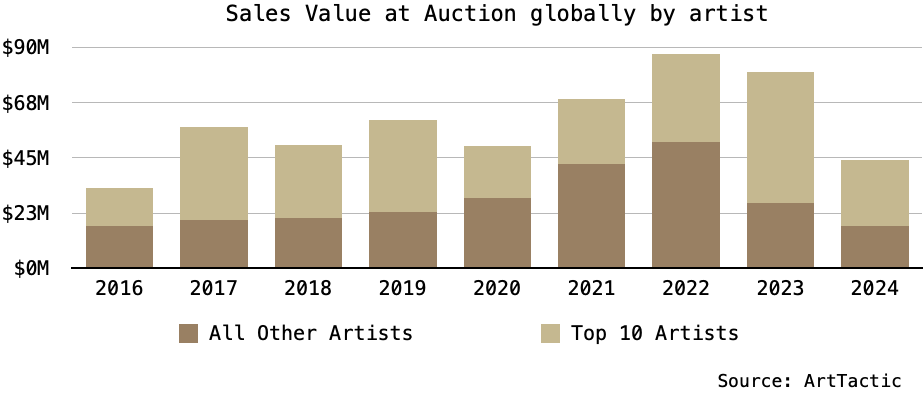

Top-Heaviness and Platform Concentration: Why Totals Swing So Violently

The top 10 artists by value consistently account for the majority of auction revenue. When one or two major works fail to clear, the headline total can drop 20%+ in a single season. This is compounded by platform concentration: Sotheby's held 50%+ market share during peak years. This is platform risk: the structural mismatch when commercial actors perform non-commercial functions in the absence of robust institutional infrastructure.

When Sotheby's ceased dedicated African art auctions in 2025, the market lost not just a venue but a validator. In categories with thin institutional infrastructure, auction platforms do more than transact—they affirm importance. The auction room becomes the public signal of value.

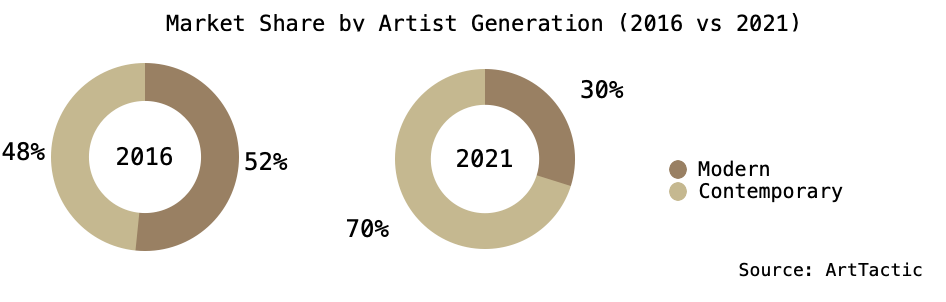

The Contemporary Trap: High Beta Without the Ballast

Mature Western markets have ballast: categories with long institutional histories and stable collector bases. A category weighted toward contemporary, particularly in the case of Africa, is especially vulnerable to market sentiment. By 2024, contemporary and young contemporary artists accounted for the majority of auction value for Modern and Contemporary African Art. This is a reflection of the assumption that auction visibility is a suitable substitute for institutional validation. A category weighted toward contemporary behaves like a high-beta asset: rises faster in expansion, falls harder in contraction. This is especially true when the institutional layer that normally stabilises contemporary careers is thin. Postcolonial modernists have already been filtered by time, scholarship, and museum acquisition; many ultra-contemporary names have not. In that gap, the auction price print can be mistaken for art-historical proof. When the prices fail to rise consistently, confidence in these contemporary artists disappears. The vulnerability is structural, not necessarily commensurate with critical reception. Without a thick layer of non-commercial institutions to absorb risk and affirm value independent of market cycles, the contemporary segment becomes excessively dependent on platform commitment and speculative momentum.

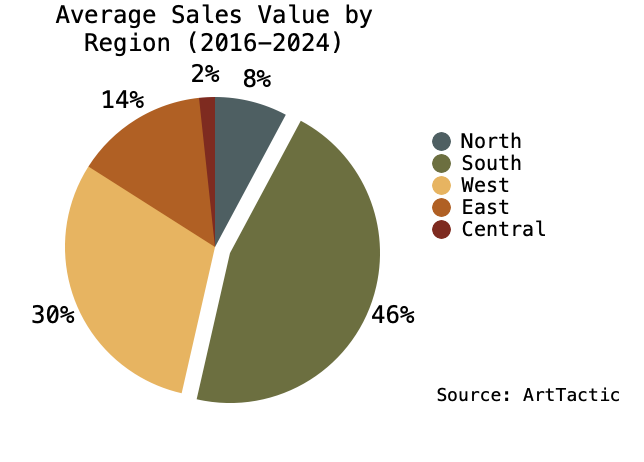

Regional Divergence and the Infrastructure Premium

"Africa" is not one market, rather it is comprised of regional markets with radically uneven infrastructure. South Africa accounts for an average of 46% of market share because its ecosystem of galleries, museums, schools, and collectors functions as shock absorption. Other regions generate global stars—Nigeria and Ghana have produced hugely successful contemporary artists—but their secondary-market capacity is thinner. This is the infrastructure premium: when Sotheby's exits, South Africa still has Strauss & Co, Aspire, and local collectors. Other markets do not have comparable backstops, which is why they experience sharper contractions. The implication is clear: building regional infrastructure—not just galleries, but the full institutional stack—is the only path to reduced volatility and sustained market development.

The Cultural Turn: Black Figuration Under Market Pressure

The boom was cultural as much as macroeconomic. 2019–2022 saw intensified appetite for Black figuration—a sub-category that became a proxy for both moral urgency and financial upside after 2020. In expansion, Black figuration translated politics into purchases. But in contraction, the market's willingness to pay for its investment narrative weakened. Speculators holding works valued on continued momentum found them harder to exit. Loyalists shifted toward historically grounded, conceptually rigorous work. This is where the repricing becomes cultural as much as financial. When Black figuration stops being a guaranteed liquidity story, the question returns: which practices hold without market hype?

Outlook and Conclusion

The 2024 correction was a stress test. It revealed that markets built on platform commitment and speculative momentum are vulnerable when platforms shift strategy. However, beneath the trophy layer, the loyalist base persisted. The boom of 2021-2022 taught the market to treat African contemporary art as a proxy for social justice and investment simultaneously. The correction thereafter separated artwork collected for art-historical significance from those collected for speculation.

If the last decade was about visibility—getting African art into the global conversation—the next decade must be about viability: ensuring the category can sustain itself when macro conditions turn and platforms change posture. The best near-term outcome is thicker underwriting: museum acquisitions, archival initiatives, scholarly foundations, research publications and curatorial programs. Commercial heat is not a substitute for institutions—it is, at best, an accelerant. Without backstops, accelerants burn hot and fast.

My projections for the market are strong. Galleries are becoming more sophisticated at navigating economically turbulent times, developing more resilient business models and bringing new collectors into the category. African wealth continues to grow, creating deeper local collector bases with long-term commitment to the ecosystem. New art institutions are emerging in previously unexplored pockets of the market—Rwanda's Gihanga Institute of Contemporary Art, pioneered by Kami Gahiga, signals the kind of regional infrastructure development that will define the next decade. The critical question is not whether growth will return—there is no doubt the market will one again reach those 2021-2022 highs. The question is whether it will be sustainable. That is entirely dependent upon the depth of the institutions and their relationship with the market.

The deeper lesson is cultural as much as financial. If we build the infrastructure—first locally, then regionally, without confusing auction headlines for art-historical consensus—then the next decade will not need to be rescued by another platform or another cultural moment's social imperatives. It will be carried by its own backstops: institutions that validate, collectors who sustain, and scholarship that endures beyond market cycles. That is the work ahead. Not louder. Deeper.